Negative balancing prices will help drive the UK storage market forward

Morning battery folks, just a quick blog to point out a few fundamental changes in the market place which can have a real impact on energy storage economics.

The last month has been a particularly volatile time for UK power, and solar has begun to make a significant impact to the peak hours. This has led to a consistent reshaping of the system balancing price, and most importantly of all negative prices in the balancing market for a few hours of the day. Negative prices are a bit of a strange concept, but basically its the grid paying people in the spot to switch off their plant. Or in our case to charge up our batteries. Why would this happen? Quite simply demand isn't big enough to meet supply, and something has to happen in the market to fix this. At the moment the problem is likely to be solved by turning down larger power stations. But this effect is going to be key to the economics of making storage work.

Negative UK balancing prices will help drive the uk storage market forward.

In another role (Catalyst Commodities) our COO Graham has produced some insightful analysis into the negative prices we've seen, please see below.

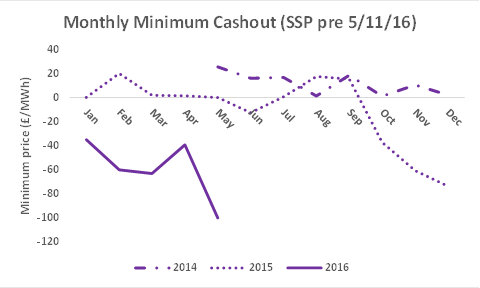

The following chart shows the minimum cashout price paid by the market to generators or charged to consumption. Where the price is negative, a generator has to pay consumption to take their generation away. For batteries, this is a great situation whereby the market pays them to charge up. The trend for negative prices is clear, and we expect more negative prices into the future as demand levels drop and renewables output increases. The more negative the cashout price becomes, the more profit available from charging your battery at these times.